Empowering Media Finance Teams: Creating New Value for Agencies and Brands

Learn why leading brands and agencies use our product to meet their goals.

Meet Hudson MXKey Stakeholders

CFO

Head of Media Finance

COO

Head of Shared Services

Blueprint Objectives

Illustrate how modern technology can empower finance personnel to help drive business results.

Inspire Finance leaders to reimagine team structure, job content, and long-term career paths.

Introduce “proactive cash flow management” resources that free up working capital.

Symptom Check: Is this Relevant for Your Team?

Your Media Finance teams know they can add even more value—if they had more time and proper tools.

It is a struggle to leverage the financial data housed in your current system of record to consistently deliver insights and analysis at scale.

Teams complain that technology is a “blocker” when it comes to innovation or new strategies.

Vision: Future State

By leveraging useful functionality—such as the ability to automatically track the status of purchase orders, real-time visibility into what is planned versus what is spent, and the ability to access centralized “pay when paid” reporting—Media Finance teams become partners in “upstream” value creation. New technology allows teams to focus on more valuable endeavors like strategic projects, commercial optimization and timely analysis, enabling them to support delivery of tangible business results for their Agencies, partners, and brands. While this process does not happen overnight—reaching this state requires coupling modern tech with a commitment to reimagining organizational structure, training, and change management—this Blueprint will give you a vision into what is possible for Media Finance teams.

Success Factors

Technology

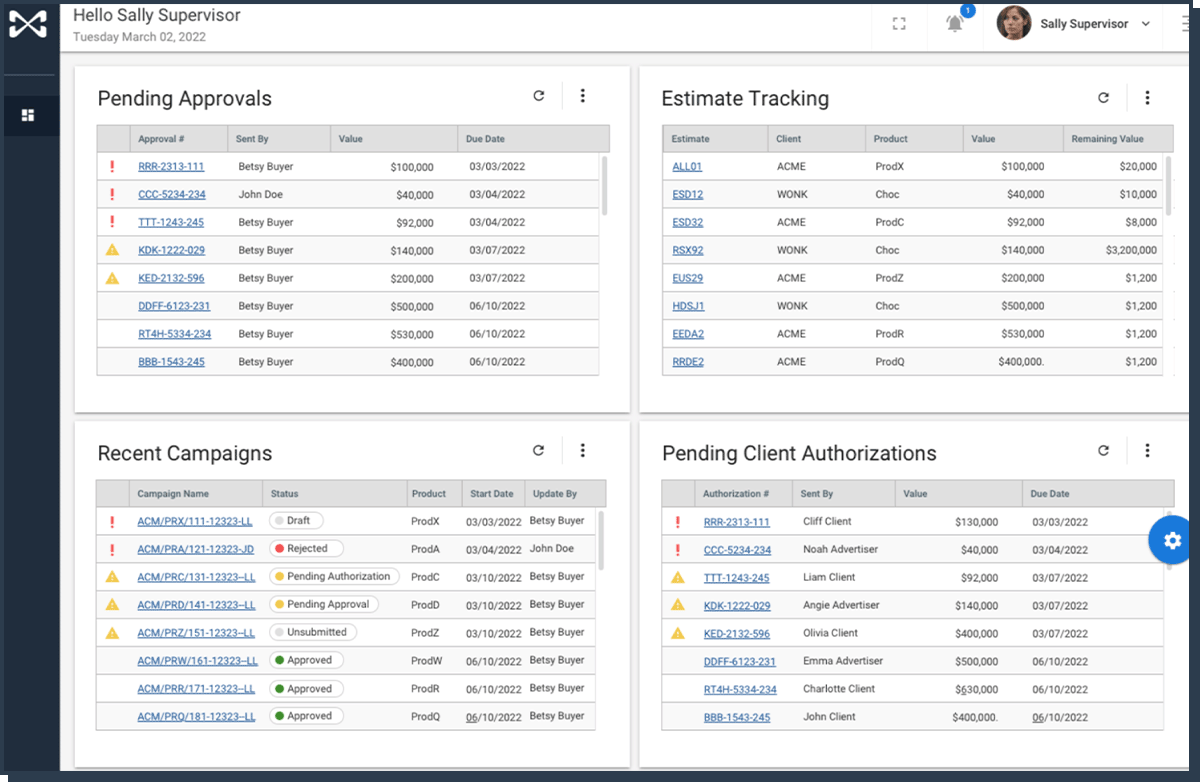

Custom, on demand reporting.

Customizable alerts and notifications.

Real time visibility into status of buys and invoices.

Advanced permissions to allow flexibility for relevant users.

Holistic real time view into global Client Finance across all of the requisite agencies.

People and Process

Defining business rules to automate tedious tasks in order to free up time for employees to focus on adding Agency and Brand value.

Gaining cross functional alignment around optimal role and scope of media finance in your organization

Allowing for thorough training and change management to enable Media Finance professionals to succeed.

Optimizing metrics for Media Finance teams and employees that drive Agency and brand success.

Introduction

It’s clear to anyone who has overseen a Media Finance group that outdated software has long been a blocker to innovation and progress. Finance teams have lacked the tools to support so much of what is essential for any well-run business in today’s digital era—from creativity and flexibility in compensation models to speedy billing to the ability to turn data into insights. This is because, historically, buying organizations had just two few options: build and maintain ''homegrown” systems or use expensive legacy technology that lacks the flexibility and speed required in today’s complex marketplace. Today, modern, fully cloud-based technology can be a catalyst, rather than a barrier, for turning Finance into a competitive advantage.

The right technology gives teams across media buying organizations the ability to reimagine processes to fully leverage talented professionals, drive go-to-market speed, deliver nimbly on unique client needs, and provide timely insights to improve return on investment for marketers. Modern software eliminates the unnecessarily tedious battle to pay invoices on time and close the books, while supporting forward-thinking finance teams in creating new value for agencies and brands.

Building the Media Finance Team of the Future

This Blueprint will focus on key areas of the media workflow where forward-thinking Finance leaders have an enormous opportunity to rethink best practices, adopt new workflows, and self-configure their optimal custom reporting suite. It’s possible to combine modern technology, optimized processes, and forward-thinking talent strategies that move your teams away from rote manual work and toward more consultative roles. The Finance team of the future can serve as trusted advisors to their clients and internal operational teams, performing the types of analyses that add significant value to agencies and marketers.

This starts with leveraging holistic, real-time visibility and customizable tools to proactively add value across what can be thought of as a value matrix for Media Finance teams of the future.

In this blueprint, our experts—veterans from the Media Finance trenches and C-suites—share examples of what’s now possible to reach the most pressing goals of media buying organizations: maximizing cash flow, decreasing risk, enhancing service delivery and increasing ROAS.

Maximizing Cash Flow

While historically this was all done via marrying together disparate systems and spreadsheets, today’s technology affords much greater control and visibility—even across multiple agencies, brands, media, and timezones. We all agree on the need to accurately manage marketing budgets in real time without hassle in order to ensure peak effectiveness. Yet systems in the past have ignored this core functionality need, forcing conscientious Finance teams to rely on manually created Purchase Order (PO) trackers and other workarounds to communicate around where a client’s spend is against their budget. The mess of paper copies and email trails lost presents a logistical and audit nightmare for teams lacking modern tools. New technology enables convenient PO-level cash flow management, faster invoice reconciliation, and real-time sequential liability tracking.

Enhancing Service

Media spend is often the largest expense marketers will incur. These teams rely on finance teams for accuracy, timeliness, and insight into their budgets at any given point in time. They also entrust media finance professionals to act as agents on their behalf, handling deals with parties such as media owners, ad tech vendors, and data providers. Doing this effectively frees marketers up to focus on growing their brands in the most cost effective ways possible. Advanced new tools can dramatically reduce turnaround times, support more elaborate contract agreements, and ensure information is instantly presentable in the most accessible formats. These are just a few of the ways modern tech can enable internal and external Media Finance teams to provide budget owners with greater peace of mind, efficiency and efficacy.

Decreasing Risk

Real-time visibility and automated workflows are two of the major ways proactive finance teams can minimize risk of errors, noncompliance, overspending and more. Modern technology makes real-time reporting available for any permissioned user to view or edit. It also eliminates the all too common need for data to be keyed and re-keyed, which often leads to errors which can be costly and time-intensive to resolve. This is relevant with respect to intercompany transactions—which can finally be seamless in today’s modern tech era.

Increasing Return On Advertising Spend (ROAS)

When it comes to media planning and execution, ultimately the work of any media or marketing team is to maximize the efficacy of a major investment. This includes the ability to add value pivots on insight and expertise. Providing truly actionable insight requires a convenient and timely way to holistically view and analyze the spend of an entire Client or Brand across media types, agencies, and even markets. Seamless inter- and cross-company workflows drastically improve the ability to leverage internal or third-party resources, as well as optimize margin, results, and even return—beginning upstream in planning phases.

How do we get there?

Below are examples of newly available technology, data, and tools that help Media Finance teams deliver impact across the value matrix.

Integrated Purchase Order (PO) Management

Getting paid faster requires a holistic, flexible way to manage a unified budget across all media, agencies, markets and workflows. Leveraging an end-to-end, unified PO record keeping system that flows through planning, buying, billing and paying workflows ensures you can easily share real-time information, prevent overspend, and automatically enable presentation of information just the way marketers want to see it. This can also substantially help eliminate errors that lead to delays downstream.

Once holistic level POs are consistently utilized for all buying throughout the buy lifecycle, Media Finance teams will be empowered to contribute new macro-level commercial insights and analyses. For example, once you create a PO across media types, products, and estimates you will be able to better track and understand spending from end-to-end.

The ability to sequentially and concurrently track, internally and externally approve, and link purchase orders to multiple estimates empowers Media Finance teams to provide end-to-end strategic impact.

Invoice Matching Rules Engine

Vendor invoice reconciliation headaches—a common challenge for Media Finance teams—are not only demoralizing for staff but also delay getting paid and making payments on time. Modern technology enables the application of “business rules” functionality, which match incoming invoices to their respective buys, at any desired level of granularity. These discrete matching rules can be set up at the Client/Brand, Product, Estimate, Media, Sub-Media, Vendor levels. Once configured, these rules allow reconciliation to occur automatically “as you go,” freeing up time and eliminating many common errors.

This means, for example, if a spend amount is different than what is shown on an invoice, your platform will immediately and automatically flag it as discrepant, enabling a buyer to quickly address it. Teams can even opt to set up notifications to alert users of discrepancies in need of attention or action.

Integrated Sequential Liability Management

The ability to view real-time cash inflows and outflows via dashboards is a game changer for Media Finance teams wishing to understand and optimize working capital for their organizations or partners. Access to a “pay-when-paid” functionality can also eliminate common errors like prematurely paying media partners without proper in-house funds. The ability to filter and customize unified billing and paying dashboards also allows media finance teams to easily forecast and proactively manage cash flow.

Privacy and control are important to delivering secure and compliant execution and service. In the past, the need to keep certain segments of information and data private limited the level of visibility and integration an integrated platform could offer its users. The ability to configure customize rules and visibility down to granular levels enables teams to control who sees what information, and when. For example, a Finance team could decide to limit user access to certain brand teams.

At the end of the day, having a real-time, holistic view of Cash Flow all in one place can be integral to optimizing performance, strengthening relationships with partners, and allowing your media buying organization to deploy funds in a way that delivers the best possible ROI.

Seamless Intercompany and Cross-Company Workflow

There are so many high-impact ways media teams might collaborate with partners to create value—from sharing heavy workloads, to accessing special expertise, to leveraging data, deals, relationships.. With any cross-team collaboration, it is essential that cross-agency workflows are convenient rather than cumbersome. Simple, streamlined intercompany and cross-company workflows can dramatically save time, improve accuracy, and enhance visibility and control.

Via this workflow functionality, agency of record (AOR) inventory, orders, and billing information can auto-populate across “sister agency”' or third-party systems to eliminate the need for duplicate data entry and reduce tedious work for buyers and finance teams. For example, whenever any partner team bills AOR, the corresponding invoice is automatically created from that bill in the AOR system, without the need for any manual action, and with accuracy and custom-configured levels of visibility for each party. This level of integration eliminates the need for a vendor invoice to be added more than once across teams. Administrators also gain client, brand, estimate-level visibility and control to strategically dictate workflow across working groups such as agency teams.

Real-time Reporting

Ultimately the work of any Agency or marketing team is that of maximizing the efficacy of the major investment made in media. As Media Finance teams are freed up from drudgery like data entry and aggregating reports by hand, they will be able to help maximize ROAS during planning, preflight and inflight phases. This ability pivots on data and insight—which are effectively “turbocharged” by the introduction of a true client or brand hierarchy. In this schema, a “Master Client” record can be configured at the highest level of granularity, allowing for a hassle-free, dynamic diffusion of real-time reporting and analysis.

Ultimate Hierarchy Flexibility Example: Agency & Client Structure

Example: Agency & Client Structure

Using this technology, administrators within the system can set up the Master Client in a centralized and advanced Master Data Management system to ensure that all information pertaining to any entity, such as a brand, is automatically unified throughout the end-to-end workflow, irrespective of employee “home company” or location. This integration can be achieved regardless of buyer, market, or media type. The ability to create custom groups of entities, such as client groups, also allows for flexible reporting, budget management, and user controls.

Historically, the capabilities of even most well-intentioned employees have historically been limited by lack of data at their disposal, or fragmented data that becomes quickly out-of-date. Real-time, holistic reporting also allows for Finance professionals acting on behalf of both agencies and brands to further avoid mistakes that lead to overspend “out of pocket” costs, and provide timely insight and analysis to the team. To help maximize ROAS, Media Finance professionals can leverage real-time, customizable dashboards to get valuable insights into the right hands to move quickly on opportunities.

To achieve this level of optimization and performance, a reporting suite must include modern capabilities to empower Finance teams to drive value at scale.

Report access should be easily manageable, by both role and specific user, ensuring data security and relevancy.

Data must be easily accessible for tracking and reporting such that any data added to the system or viewable onscreen is readily available for reporting and tracking.

Non-technical internal personnel should be able to pre-set standard reports or use a customizable report builder for ad-hoc analysis.

Users must be able to easily view, analyze, and share information at the right level of granularity. A reporting engine must address the needs of an entire enterprise—from team-specific reports and senior executive dashboards, to “Master Client” status updates.

Billing Rules Engine and Billing Profiles

Unlike other systems that depend on separate areas of their tool for functions like billing media, commissions, tech and data fees, and travel and entertainment expenses, a more advanced solution allows for fully consolidated billing and offers an advanced, flexible billing rules engine. By allowing unlimited possibilities in how and when clients pay agencies for their services, technology is no longer a barrier to performance-based or other methods of compensation. Regardless of the commercial fee structure, bills can be viewed and approved easily across agency and brand teams. These configuration rules and profiles can easily be set up by non-technical staff using simple “if/then” logic and intuitive interfaces, at the Client, Product, Estimate, Media/Sub-Media, Supplier, and Cost field levels. Therefore, billing rules can be configured for tiered commission and outcome-based structures, with the assurance that only desired information is displayed on a final bill. Ultimately, service and client experience is enhanced due to the ability to seamlessly drill up and down as necessary. The system does not prohibit the use of creative and elaborate ways of forming commercial agreements.

Conclusion

Expanding the role of Media Finance teams leads to better overall service and return for budget owners while enhancing employee satisfaction and retention. No matter what the future holds for the media landscape, marketers will always rely on their media buying counterparts for reliable financial management. By leveraging advanced technology, Media Finance teams can continually help their organizations deliver greater and greater value. Providing increasingly savvy financial management will ultimately transform Media Finance teams—elevating them to more strategic roles within their organizations and the industry.

Want to learn more? Get in touch.

More from MX Insights